IRC Americas Program Special Report

NAFTA, Corn, and Mexico’s Agricultural Trade Liberalization

by Gisele Henriques and Raj Patel | February 13, 2004

Americas Program,

Interhemispheric Resource Center (IRC)

www.americaspolicy.org

Even well before NAFTA, successive Mexican governments embraced free trade with remarkable zeal. Beginning with its membership of the General Agreement on Tariffs and Trade (GATT) in 1987, Mexico has signed more trade agreements than any other country in the world. In 1994, Mexico joined the Organization for Economic Cooperation and Development (OECD) and that same year NAFTA was implemented. Although academic experts are divided on the merits of trade liberalization 1 , the Mexican state continues to view it as a panacea for poverty and underdevelopment. The evidence, however, suggests that free trade agreements in general, and NAFTA in particular, have exacerbated the problems facing the rural poor in Mexico.

Trade liberalization has had a major impact on Mexican agriculture, and specifically on corn farming. Since many of the poorest people in Mexico engage in corn production, it serves as a barometer for the condition of the most marginalized groups in Mexican society. After ten years of NAFTA, results show that the poorest have fared exceptionally badly. In asking what went wrong, it is important to note that not all of the increase in rural poverty can be attributed to membership in NAFTA. NAFTA is part of a wider constellation of policies and policy changes that affect the rural poor. Mexican trade liberalization was accompanied by national policy revisions that did away with government support programs and, instead, focused on increasing export led-growth. It is therefore analytically very difficult to attribute negative impacts exclusively to any particular free trade agreement.

NAFTA is a moment in a wider policy process in which the Mexican government has increasingly prioritized the needs of some of its citizens over others.

Background The architects of the North American Free Trade Agreement (NAFTA) knew that in the short run there would be winners and losers under the agreement. The potential losses for Mexico were mainly concentrated in the agricultural sector–particularly for import-competing farmers. Although agriculture accounts for less than 5% of the gross domestic product, one-quarter of the Mexican workforce still lives off the land 2 . The geographical and social distribution of the “losers” was also predictable–small farmers and people who were already poor, primarily in the south.

The argument, used at the time of NAFTA’s signing, was that trade liberalization would let the stiff winds of competition blow through a stagnant agricultural sector. Yet this policy was always going to hit different groups in different ways, especially given the variegation that exists within Mexican agriculture. Mexico ‘s climate ranges from desert wasteland conditions in the North to tropical conditions in the Southeast, which affords it the possibility of engaging in diversified production. The country is mostly mountainous and much of it is arid; only 11.8% of land area is arable 3 .

The scarcity of high-quality land creates disputes; those with political or economic power have tended to wield it in order to secure this resource. The issue of land and land rights forms a backdrop for understanding much of Mexican history and still generates conflicts today. According to the Mexican agricultural ministry (SAGARPA, by its Spanish initials), of those in the economically active population in agriculture, 6.6 million are workers without land. 4 In addition to climate and access to land, the impact of trade liberalization depends on the characteristics of the farmers, the resources available to them, their ability to adjust to changes in prices, and their access to credit and extension services; irrigation channels, soil quality, technology transfer, crop storage facilities, and insurance are all determining factors.

Rural Poverty and Agriculture

Indicators of rural poverty show a larger incidence of poverty, and deeper poverty in 1998 than in 1989 5 . The most recent numbers provided by the Mexican Agricultural Ministry, SAGARPA, state that as of 2001, 81.5% of people in rural areas were living in poverty. For the economically active population in agriculture the incidence of poverty increased from 54% in 1989 to 64% in 1998 6 . A study by Mexico ‘s center for Economic Research and Teaching found that since 1992, the proportion of workers employed in agriculture has shrunk by 10% and that rural wages are 30% lower than other sectors of the economy, such as construction 7 .

For those living in the countryside, agricultural production does not adequately provide for household needs. On average 44% of household incomes come from non-farm wages 8 and about 80% of families living in rural areas have at least one family member living outside of the community 9 . These figures speak to the vulnerability of those living in rural areas and the various survival strategies they must employ 10 .

Although the NAFTA period has seen a slight increase in the average per capita GDP, this did not translate into a decrease in rural poverty in Mexico. One reason is that the average annual growth rates in the agricultural sector have been irregular; it averaged 1.7% in the 1990s, 0.6% in 2000 and 1.9 % in 2001. 11 Agriculture’s role in the national economy has been slipping: currently, 4.4% of the GDP can be attributed to agricultural production, down 4 percentage points from 1980.

Moreover, while foreign direct investment (FDI) rose during the NAFTA period 1994 to 2000, only 0.3 % went into agricultural production. 12 The majority of FDI in agriculture has gone into secondary and tertiary agricultural products. FDI in the food processing industry increased from $2.3 to $5 billion from 1993 to 1997. 13 Through NAFTA and other trade agreements, Mexico succeeded in attracting initial or expanded investment from large agribusiness. Birdseye, Green Giant, Campbell ‘s Soup, Hunt, Arthur Daniels Midland, Conagra, Cargill, and Tyson’s have all significantly increased their operations in Mexico. Green Giant recently moved one of its food processing plants from Watsonville, CA to Mexico and Cargill de Mexico has invested U.S.$184 million in Mexican facilities. This has resulted in a consolidation and significant concentration of transnational ownership in the food processing sector. During this time, these companies’ profits have skyrocketed. Cargill, which controls about one-quarter of the grain trade, posted profit increases from $350 million in 1992 to $597 million in 1999. Other companies such as Arthur Daniels Midland saw profits increase threefold since they started investing in Mexico in 1993, from $110 million in 1993 to $301 million in 2000. Similarly, Conagra’s profits grew 189% from $143 million in 1993 to $413 million in 2000.

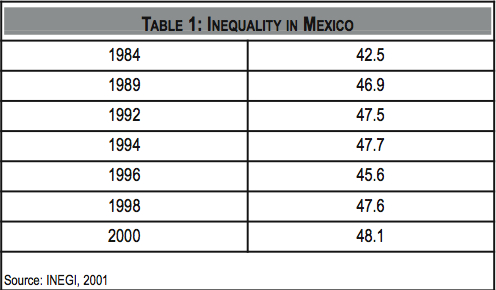

This situation is mirrored elsewhere. A recent World Bank paper found that greater openness to trade is negatively correlated with income growth amongst the poorest 40% of the population 14 . Inequality threatens the economic gains made in other sectors of society. Sustained economic growth cannot be achieved without equality–and the more unequal a society is, the more likely it is to suffer from political and social unrest. In Mexico , the richest 10% of the population receives 42% of total national income, while the poorest 40% receives just over 11% 15 . The Gini index ranking, a widely used measure of inequality, has also been increasing since the mid 1980s. Table 1 shows the results. (A Gini index of 100 is perfect inequality, an index of 0 represents perfect equality.)

Growing inequality has been joined by rising unemployment in the Mexican countryside. The Mexican government predicted that “inefficient” farmers would reallocate production to horticultural crops and that that market would grow to absorb new producers. But Mexico already accounts for 60% of total horticultural imports to the U.S. 16 and Mexico’s additional share in that market is constrained by competition with other countries and U.S. producers. Moreover, areas of high rural expulsion and unemployment are largely unsuited to horticulture for soil, climate, and topography reasons. Currently fruit and vegetable production accounts for only 15% of total agricultural production, employs just 18% of the agricultural labor force 17 , and makes up just 8.6% of cultivated land 18 .

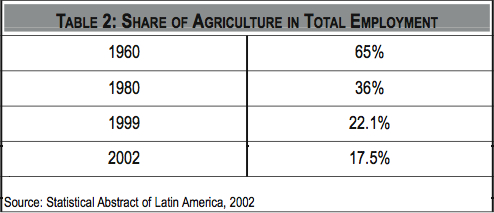

The agricultural sector’s decreasing share of total employment is a sign that labor is relocating to other sectors and migrating out of rural areas:

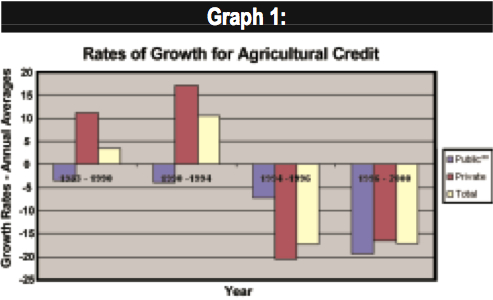

Finally, the withdrawal of government support programs, and the private sector’s inability to or lack of interest in filling these roles, has left small agricultural producers out in the cold. The situation in financing illustrates the current dilemma in Mexico. Access to agricultural credit has decreased at an alarming rate, as seen in Graph 1.

The private sector increased agricultural credit in the early years of market-oriented export policies but reduced interventions thereafter. Banrural , a rural development bank, attempted to compensate for the private sector’s retreat from unprofitable agricultural lending, only to go bankrupt itself in 2001. The lack of availability of financial support to small farmers cripples any attempt at improving production, as credit is critical for poor farmers’ production investments.

Corn in Mexican Society

Mexico is the birthplace of corn and cultivation began 5,000 years ago; today there are over 41 landraces and thousands of corn varieties in Mexico. Such genetic diversity forms a rich reservoir of genetic resources that can help cope with adverse environmental conditions and can play a crucial role in meeting the challenges of world food demand. 19 Beyond the utilitarian argument for the preservation of corn, corn production and consumption are deeply intertwined in the nation’s social and cultural fabric. The social significance of maize in Mexican society runs deep. Yet free-trade planners failed to take these elements into account, leading to their inability to predict widespread refusal to abandon corn production and other “non-market” behaviors characteristic of the post-NAFTA agricultural landscape in Mexico.

Corn in Mexico accounts for 60% of cultivated land, employs 3 million farmers (8% of Mexico’s population and 40% of people working in agriculture) and is the country’s main staple food crop. 20 There are a total of 18 million people 21 dependent on corn production, including farmers and their families. 22 Seventy-two percent of national corn-producing units are organized into ejidos –mostly small-scale holdings that account for 62% of corn production. Corn production accounts for more than two-thirds of the gross value of Mexico ‘s agricultural production, while horticultural crops account for only 6%. 23

The most competitive corn producers are found in the northwestern and north-central states of Sonora and Sinaloa. These states are mostly arid and semi-arid and production is highly dependent on irrigation, mechanization, fertilizer, and pesticide use. These were the largest recipients of state investment in agriculture in the 1940s and have benefited the most from NAFTA since they are closest to the United States and have higher yields. But the states with the greatest concentration of corn producers are in the central and southern part of the country–Chiapas, Guerrero, Hidalgo, Oaxaca, and Veracruz . These states have the highest incidence of poverty and are also where the majority of subsistence producers farm seasonally on small plots of land, with no irrigation and low yields.

There are considerable differences between corn production in Mexico and in the United States . First, the U.S. is the world’s largest producer of yellow corn, normally used for animal feed, while Mexico is the largest producer of white corn, preferred by Mexican consumers. Mexico has also retained far more local varieties, while the U.S. has concentrated heavily in a few. Second, the U.S. uses technology-intensive production, including heavy chemical use and mechanization. Mexico’s steep and mountainous terrain makes it difficult to introduce mechanized production as used in the wide-open fields of the U.S. Midwest, and small farmers often use far less chemicals on their land due to cost. Second, Mexico averages 1.7 tons of corn per hectare while the United States averages 7 tons. To produce one ton of corn in Mexico, on average, 17.8 labor days are required to the U.S.’s 1.2 hours. 24 This average again hides a great deal of variation, however–on some modern, irrigated Mexican farms, yields are comparable to the United States. Nonetheless, 80% of total area of corn cultivation in Mexico is rain-fed and frequently difficult to cultivate because of steep slopes and poor soil.

The Impacts of Free Trade

While many of the arguments for NAFTA rested on assumptions around idealized free markets and their benefits, the reality on the ground has been rather different. Since Mexico began importing corn from the United States, Mexican producers have found themselves competing directly with U.S. producers selling at prices significantly lower than those in Mexico . Low U.S. corn prices set the international price because the U.S. is the largest producer and exporter of the crop 25 . International corn prices are currently $1.74 a bushel and the latest U.S. Department of Agriculture figures show production costs at about $2.66 a bushel. This difference is compensated to the farmers through direct and indirect subsidies. To put this into perspective, U.S. farmers received $18 billion in subsidies and account for less than 3% of the labor force 26 , while Mexican agricultural support programs contributed about U.S.$ 9 billion in 2002 to producers. 27

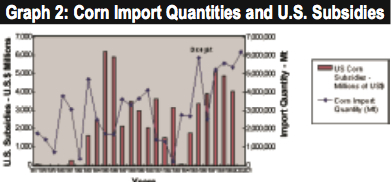

U.S. government subsidies move the relationship between international supply and demand for corn far away from the “apolitical” world of free trade economics. Low international prices have led to increased Mexican imports, but the magnitude of subsidies provided by the U.S. government removes competition from the theoretical field of comparative advantages into a far more complex political terrain. Graph 2 gives us an insight into how market forces are directly manipulated by international political exigencies which have little to do with “free trade”. There are two clear spikes in the graph. The first in 1983 was a direct result of the first Peso crisis. As part of the bailout package, the U.S. Department of Agriculture gave a $1 billion Commodity Credit Corporation concessional loan, in exchange for which Mexico agreed to purchase U.S. surplus corn. 28 As Lustig notes, this facility had been used before. 29 A similar process was behind the second spike, between 1995-6 at the time of the second peso crisis, during which predictions of drought in the country’s major corn-producing regions combined with large corn importers’ need for access to capital and led to record imports. 30

As expected, over the course of NAFTA, domestic corn prices in Mexico have tended to align with international prices. Trade agreements work in tandem with other political priorities, such as a commitment to phase out producer supports and to dismantle CONASUPO, combining to affect producer prices. But this isn’t the whole story.

Corn Production Remains Stable

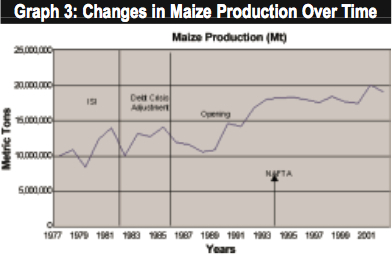

Economic theory suggests that when prices decrease, production should also decrease. In theory, producers should receive these price signals and cease to grow corn because it is no longer profitable. But as Graph 3 shows, production has remained stable, even increasing slightly after NAFTA.

The stability of corn production despite lower prices is inconsistent with straightforward laws of supply and demand. Something else is going on. This paradox can be explained by a variety of factors:

Lack of Options : Many producers do not have readily available options to switch to more competitive crops; this is because they lack assets like credit and technology or because they work in poor-quality soil. They increase their production, in spite of the declines in price supports and corn prices, in order to maintain income levels. Such producers have few alternatives and hence place greater pressure on the only production factors available to them–land and labor.

Increased Yields and Expansion of Land under Cultivation : Production growth may be related to increased yields, often a result of increased pesticide and fertilizer use, as well as the expansion of land under cultivation. A study of corn production by Alejandro Nadal in Oaxaca shows that 25% of production growth was due to increased yields, and 65% was due to expansion of land under cultivation. 31 Producers in Oaxaca are increasing output due to increased economic stress and with that increasing pressure on lesser quality lands and the environment.

Safe Crop : Corn was once highly protected and many have identified it as the least risky crop for production. Risk-averse farmers, especially those producing at subsistence levels, continue to identify corn as a safe crop.

Staple : Since corn is a staple, many subsistence farmers will continue to grow it for family consumption despite decreases in price.

Culture and Tradition : Corn has been cultivated in Mexico for generations and is used in rituals, ceremonies, religious services, traditional culinary practices, and healing. Corn historically forms the backbone of Mesoamerican cultures, many of which are alive today in the thousands of corn-growing indigenous communities across Mexico .

Price of Substitutes : The decision to grow corn is not based only on the prices of corn; it also depends on the prices of other crops and the conditions available to farmers to grow those other crops, such as suitable land and inputs. Liberalization has also opened the market to world prices in other goods; under such conditions, it is unclear that farmers have any other crops to which they might profitably switch.

The reasons outlined above explain farmers’ seemingly illogical choice to keep producing corn despite lower prices. Farmers recognize the importance of price signals, and, contrary to the arguments of government officials, prices affect even subsistence farmers. But given the lack of alternatives and the multi-functional nature of corn production in campesino life, many have reacted contrary to “market expectations”–they are sowing more corn, not less.

Heterogeneity among Corn Farmers

As mentioned above, not all of Mexico ‘s farmers have suffered under NAFTA. “Competitive farmers” with access to high-quality land, credit, and, perhaps most importantly, government support, have fared well under the trade agreement, even if this has meant shifting away from corn to other commodities. 32 But these constitute the minority and for subsistence farmers, the prognosis is not healthy.

Subsistence farmers, small farmers who own less than 5 hectares of land, 33 account for 45% of all corn-growing units in Mexico . 34 Production for household consumption represents 38% of their total production. 35 For the most part they farm poor-quality, rain-fed soil on sloping terrain; they face irregular rainfall, and little or no access to technology, credit, storage facilities, and marketing channels. Many of these farmers work on ejidos and their yields are 16% and 26% lower than privately owned plots of rain-fed or irrigated land respectively. These producers are often forced to sell their yields right after harvests, when local prices are at the lowest, because they lack storage facilities. They sell small amounts of the corn they produce and their own labor to supplement household income needs. A 1994 ejido survey found that 41% of ejidarios were selling part of their production. There is a strong positive correlation between subsistence production and poverty. 36

Subsistence farmers are particularly affected because they lack assets and face higher transaction costs in production. They are the worst off in Mexican agriculture because, on their own, they lack the capability of switching production to more profitable crops for export and are taken advantage of by intermediary buyers. Some small farmers have organized cooperatives or grassroots organizations; while that has improved their bargaining ability with both buyers and the government, they continue to face extreme disadvantages.

These producers are strongly affected by monetary flows and changes. Although Yunez and others have argued that these producers are not as susceptible to changes in the price of corn because they produce mostly for household needs, such a view ignores the fact that not only do they conduct petty sales to supplement household liquidity needs, they are petty buyers and laborers, and often depend on corn production on larger farms for their wages. 37 Adverse employment effects for this group are likely if intermediate farmers cease to produce or chose to mechanize production.

Tortilla Price Increase

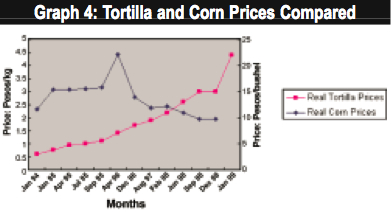

The case of corn in Mexico demonstrates how the theory of free trade has often been at variance with the realities of international and production economics. Another premise that has not been borne out is that free trade will benefit consumers by providing lower prices. Over the NAFTA period the domestic price for corn has fallen. But the price of corn food–especially the Mexican staple, the tortilla–did not decrease; in fact, it has increased 279%.

The reasons for this are twofold: first, and most important, tortilla prices were subsidized until 1996, when manufacturers were able to transfer their increased costs to consumers. Second, the Mexican tortilla market is a monopoly where the two largest companies–GIMSA and MINSA–account for 70% and 27% of the market respectively. 38 These companies operate like cartels, using their market power to set higher prices. The graph below traces consumer prices for tortillas from 1994, when prices were still subsidized, to 1999, well after liberalization. Imposed on the same graph are the real prices of corn in Pesos per bushel, which is how much Mexico is paying for imported corn.

The data in Graph 4 actually underestimate the impact of the tortilla price increase, since it covers Mexico City and the surrounding metropolitan area, a zone where the trade ministry has maintained some degree of price control. For the rest of the country, including rural areas, price increases were significantly higher 39 .

Tariff Rate Quotas Not Enforced

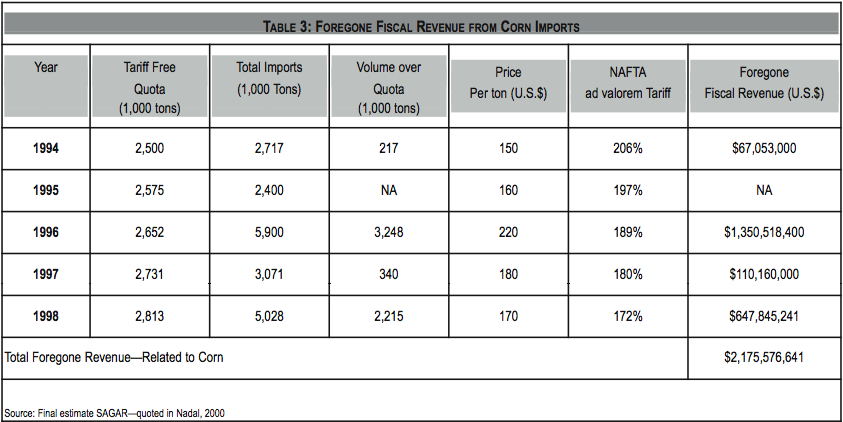

A strong political component operates in the distribution of costs and benefits that reflects both power relations within Mexico and within the international trade system. To illustrate: the Mexican government could have used NAFTA regulations to protect the corn sector until 2008, giving its farmers a longer adjustment period. During the first year of NAFTA, Mexico ‘s tariff-free import quota was set at 2.5 million metric tons of corn. This quota was to expand at a compounded rate of 3% a year starting in 1995, continuing until 2008 when the tariff-free import quota would have reached 3.6 million metric tons of corn.

But the Mexican government did just the opposite. Since NAFTA implementation began, annual imports of corn into Mexico have always exceeded the allotted tariff-free quota. 40 Mexico could have collected revenues from these above-quota imports. Yet all corn imports into Mexico since the signing of NAFTA have been excused from tariff payments. Instead of phasing out corn tariffs in 15 years as planned, the tariffs were phased out in 30 months. The planned 15-year transition period was compressed between January 1994 and August 1996, when prices fell 48% forcing Mexican producers into a rapid adjustment. This accelerated process took place along with decreases in government support for farmers, further compounding the adverse effects on corn farmers. The decision to truncate the adjustment period proved favorable to large companies importing corn as animal feed.

Fiscal revenues foregone due to the government’s failure to implement the “tariff rate quotas” (TRQ) for corn are estimated to be more than $2 billion, illustrated in Table 3. Reasons for the government’s failure to impose the TRQ range from inefficient and disorganized control mechanisms at the border, to a perceived need to lower prices and reduce inflationary pressures. According to Yunez 41 , the Zedillo government was concerned with securing cheap corn for processors, which reflects the skewed balance of power between corn processors and producers. Up until quite recently, producers were not even represented on the committee to set import quantities–although processors figured prominently in these decisions. The administration also feared that if corn importers had to pay the tariffs such prices would be shifted to consumers through higher tortilla prices. As described above, tortilla prices rose anyway.

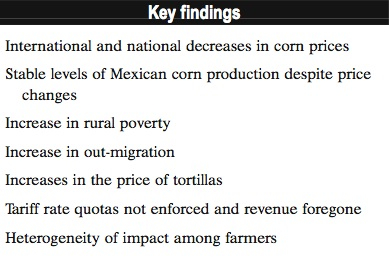

Conclusions

The exact impact of trade liberalization on import-competing producers cannot be generalized without considering the heterogeneity among them. A few large farmers and transnational food conglomerates 42 have done well under liberalized agriculture in Mexico . Yet their success masks, in aggregate, the plight of smaller subsistence farmers. Subsistence producers are among the poorest segment of the population, and their deprivation has resulted in increased environmental degradation (through panic use of forested land), increased poverty, and migration.

These groups have made their voices heard forcefully, through protest. Their demands reflect the disconnect between the centrally and undemocratically conceived vision of liberalization concocted in the 1980s with a reclamation of real national development. The Mexican experience serves as a warning to other governments on the brink of adopting similar policies, both that the policies do not work, and that there is a high political cost in pursuing them. The route of democracy may seem superficially less convenient, but peasant movements around the world have, increasingly, found that if democratic participation is not offered in the formulation of agricultural policy, they will find other ways to make their voices heard.

Gisele Henriques and Raj Patel are researchers at Food First/The Institute for Food and Development Policy.

For More Information

http://www.tradeobservatory.org/ a resource center from the Institute for Agriculture and Trade Policy.

http://www.foodfirst.org/wto/ from the Institute for Food and Development Policy.

http://www.unorca.org.mx/omc/index.htm has trade-related information in Spanish and English.

Endnotes

See, for instance, Weisbrot and Baker 2002 available at http://www.cepr.net/relative_impact_of_trade_liberal.htm , UNDP 2003 Human Development Report, and Rodrick, D. (2001) The Global Governance of Trade as if Development Really Mattered.

Smith, G. Mexico’s Farmers are Getting Plowed Under Business Week Online, November 18, 2002.

World Guide. Mexico Chapter Instituto del Tercer Mundo, 1999-2000. Uruguay.

World Guide, 1999-2000.

These are the p-alpha indicators used to measure different facets of poverty. The incidence of poverty refers to the number of people living below poverty (head count), while the poverty gap is the amount needed for those living in poverty to reach the poverty line and the depth of poverty indictor grants greater weight to those living furthest from the poverty line.

Statistical Abstract of Latin America, 2002.

Cevalos, Diego. Increased Farm Subsidies in US Another Hard Blow to Mexico Third World Network, May 2002.

Sagarpa, Ministry of Agriculture. National forum on integrated rural development, March 2001.

Sagarpa, 2001.

Examples of survival strategies include: migration, hiring out family labor, foregoing purchases and expenses when possible, etc.

World Bank Group. Mexico Profile 2002, www.worldbank.org .

Carlsen, Laura. The Mexican Farmers Movement Americas Policy Report. February 25, 2003.

Carpentier, Chantal. Trade Liberalization Impacts on Agriculture: Predicted vs Realized Environment, Economy and Trade, CEC, December 2001.

World Bank in Wise, Salazar and Carlsen. Confronting Globalization: Economic Integration and Popular Resistance in Mexico Kumarian Press, 2003.

Wise, Salazar, and Carlsen, 2003.

Nadal, Alejandro. The Environmental Impacts of Economic Liberalization on Corn Production in Mexico, Oxfam GB and WWF International, September 2000.

Malaga, Williams, and Fuller. US-Mexico Fresh Vegetable Trade: The Effects of Trade Liberalization on Economic Growth Department of Agricultural Economics, Texas Agricultural Market Research Center, January, 1998.

De Ita, Ana. The Impact of Liberalization on Agriculture in Mexico: From GATT to NAFTA. www.laneta.org .

Nadal, 2000. See also See Food First’s Anatomy of a Gene Spill for the recent effects of genetic contamination in Mexico, at http://www.foodfirst.org/pubs/backgrdrs/2002/sp02v8n2.html

Nadal, 2000.

The average Mexican family has 6 dependents so 3 million times 6 is 18 million.

Nadal, 2000.

Nadal, 2000.

Rosset, P. and Burbach R. Chiapas and the Crisis of Mexican Agriculture Food First Policy Brief, December 1994.

Murphy, 2001.

Cevalos, 2002.

Cevalos, 2002.

Goldzimer, Aaron. Worse Than the World Bank? Export Credit Agencies–The Secret Engine of Globalization, Food First Backgrounder, Volume 9, no. 1 Winter 2003, available at http://www.foodfirst.org/pubs/backgrdrs/2003/w03v9n1.html

Lustig, Nora. Mexico in Crisis, the U.S. to the Rescue: The Financial Assistance Packages of 1982 and 1995, 1997., available at http://www.brookingsinstitution.org/views/articles/lustig/1997bi.htm

Luis Hernandez Navarro, personal communication. See also Carlsen, Laura. “The Corn Conundrum: Corn import debacle plays up weaknesses in agricultural policy.” Business Mexico, July 1997 and http://www.eco.utexas.edu/~archive/chiapas95/1996.12/msg00397.html

Nadal, 2000.

Nadal, 2000. p51. In the classification of competitive, “medium,” and subsistence farming, Nadal notes correctly that a direct correlation between farm size and competitiveness is not possible. The terms small, medium, and large don’t map onto any given measure of acreage because of factors such as land tenure regime, quality of land, and which state the farm is in all affect the economics of farming. The categorization here, then, is admittedly post hoc, but one that helps nonetheless in disaggregating the social effects of economic liberalization.

This definition is borrowed from Nadal, 2000.

INEGI, 1994.

CONASUPO, 1993.

Nadal, 2000.

Yunez, Antonio. Lessons from NAFTA: The Case of Mexicos Agricultural Sector World Bank, December 2002.

Nadal, 2000.

Nadal, 2000.

Nadal, 2000.

Yunez, 2002.

Schwentesius, Rita and Gomez, Manuel Angel. Supermarkets in Mexico: Impacts on Horticulture Systems, Development Policy Review 20(4), 2002, pp 487-502

Join our network to receive email announcements that tell you when new items like this article are posted to the Americas Program website. Information on our privacy policy is available on our network sign-up page.

We want your Feedback . Tell us what you think of this article. Your comments may be published in our CrossBorder UPDATER or UPDATER Transfronterizo .

Published by the Americas Program at the Interhemispheric Resource Center (IRC, online at www.irc-online.org ). ©2004. All rights reserved.

Recommended citation:

Gisele Henriques and Raj Patel, “NAFTA, Corn, and Mexico’s Agricultural Trade Liberalization,” Americas Program (Silver City, NM: Interhemispheric Resource Center, January 28, 2004).

Web location:

http://www.americaspolicy.org/reports/2004/0402nafta.html

Production Information:

Author: Gisele Henriques and Raj Patel

Editors: Laura Carlsen, IRC

Layout: Tonya Cannariato, IRC